19+ paycheck calculator new hampshire

The New Hampshire Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit.

Long S Bulrush Scirpus Longii Cosewic Assessment And Status Report 2017 Canada Ca

New Hampshire Income Tax Calculator 2021.

. New Hampshire Cigarette Tax. New Hampshire Hourly Paycheck Calculator. 19 paycheck calculator new hampshire Minggu 23 Oktober 2022 Edit.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. Browse our listings to find. Your Details Done Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Estimate your take home pay after income tax in New Hampshire USA with our easy to use and up-to-date 2022 paycheck calculator. We designed this handy.

New Hampshire Gas Tax. New Hampshire Hourly Payroll Calculator - NH Paycheck Calculator. Calculating paychecks and need some help.

Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New. That tax applies to both regular and diesel fuel. New Hampshire residents also dont pay too much state tax at the pump.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Hampshire. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance. New Hampshire Paycheck Calculator Use ADPs New Hampshire Paycheck Calculator to.

Can claim state exemptions. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4. Ratings for New Hampshire Paycheck Calculator.

New Hampshire tax year. New Hampshire Hourly Paycheck and Payroll Calculator. The gas tax in New Hampshire is equal to 2220 cents per gallon.

Ad See the Paycheck Tools your competitors are already using - Start Now. New employers should use. Ratings for New Hampshire Paycheck Calculator.

Read reviews on the premier Paycheck Tools in the industry. Need help calculating paychecks. This free easy to use payroll calculator will calculate your take home pay.

Your average tax rate is 1198 and your. No state-level payroll tax. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. If you earn normal wage there is no income tax. Supports hourly salary income and multiple pay frequencies.

Paycheck Calculator Take Home Pay Calculator

Literacy Support For Individuals Families Community Organization

Iec Officially Announces The Election Results Steve Tshwete

Employability Hub Access Southampton

New Hampshire Income Tax Calculator Smartasset

Employability Hub Access Southampton

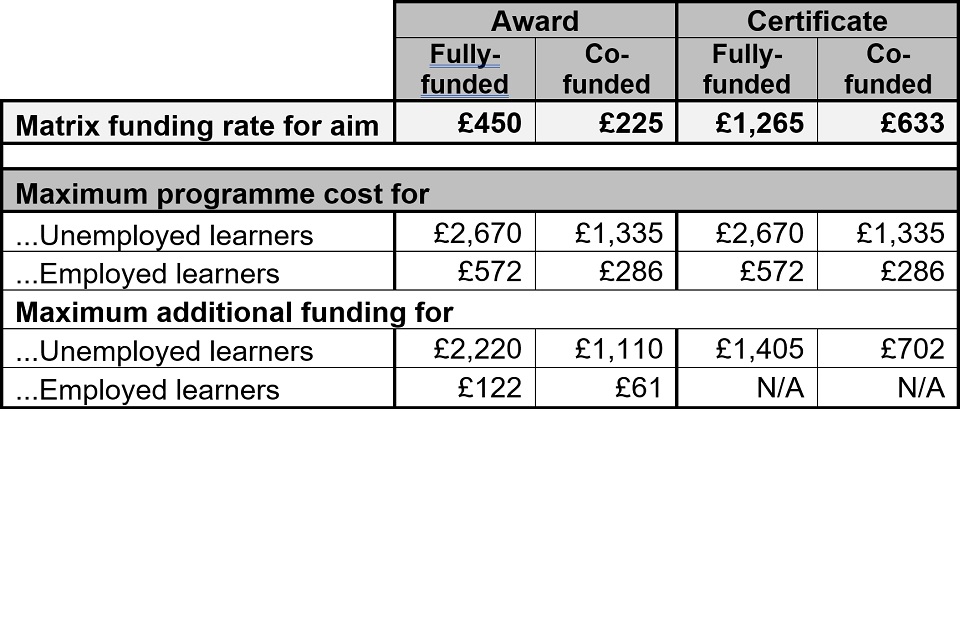

Esfa Funded Adult Education Budget Funding Rates And Formula 2022 To 2023 Gov Uk

Payslip Templates 28 Free Printable Excel Word Formats Excel Templates Business Template Templates

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

New Tax Law Take Home Pay Calculator For 75 000 Salary

New Hampshire Income Tax Calculator Smartasset

Butternut Juglans Cinerea Cosewic Assessment And Status Report 2017 Canada Ca

Free Paycheck Calculator Hourly Salary Usa Dremployee

Employability Hub Access Southampton

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Hampshire Salary Paycheck Calculator Gusto